The Big Picture: Trade Rules Are Moving Faster Than Your Price Book

Global trade policy is a moving target. Overnight, duties, surcharges, and shipping premiums can spike—often without warning—and every one of those adjustments lands squarely on your balance sheet. Think of it as a “silent tax”: it chips away at gross margin long before a unit ever hits the showroom or a part makes it to the counter.

For multi-location dealers selling everything from powersports and trailers to marine, RV, and agriculture equipment, that silent tax poses the same fundamental question:

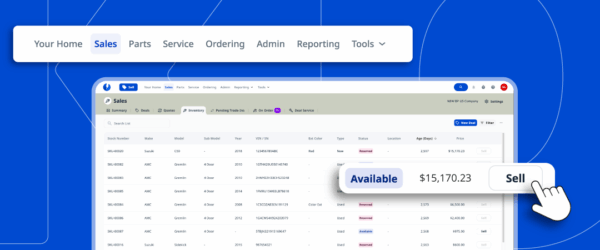

Can you see the true cost—and profit—of every unit and part in real time?

If the answer is “no” or “I’m not sure”, keep reading.

What Is Landed Cost and Why Does It Matter?

Most Dealership Management System (DMS) price books start with the invoice cost. But invoice cost is only one layer in a five-layer cost structure:

- Invoice / FOB price

- Freight & insurance

- Tariffs, duties & surcharges

- Brokerage/clearance fees

- Currency variance

Miss, mis-code, or delay any piece of that cake and margins skew—pricing decisions lose their footing.